Understanding General Insurance

Introduction:

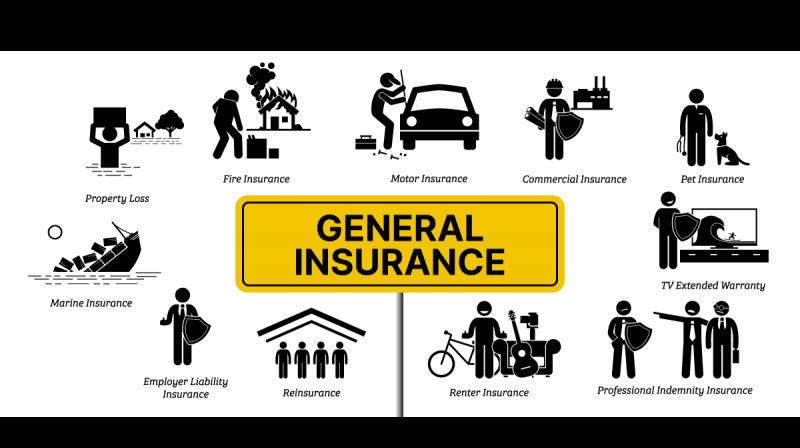

General insurance plays a crucial role in protecting individuals, businesses, and assets from unexpected financial losses. Unlike life insurance, which covers risks related to death, general insurance encompasses a wide range of policies that provide protection against various risks such as property damage, liability, and medical expenses. In this article, we delve into the fundamentals of general insurance, its types, importance, and how it benefits individuals and businesses alike.

Understanding General Insurance:

General insurance, also known as non-life insurance, is a contract between an insurer and a policyholder where the insurer agrees to compensate the policyholder for financial losses incurred due to covered events. These events can include natural disasters, accidents, theft, illness, and more. Unlike life insurance, which provides financial support to beneficiaries in the event of the policyholder’s death, general insurance provides coverage for a specific period and ceases once the policy expires.

Types of General Insurance:

- Property Insurance:

- Property insurance protects against losses and damages to physical property such as homes, vehicles, and businesses. It includes policies like homeowners insurance, renters insurance, auto insurance, and commercial property insurance.

- Liability Insurance:

- Liability insurance provides protection against legal liabilities arising from injuries, damages, or negligence. This includes general liability insurance for businesses, professional liability insurance for professionals like doctors and lawyers, and product liability insurance for manufacturers.

- Health Insurance:

- Health insurance covers medical expenses incurred due to illness, injury, or hospitalization. It includes individual health insurance, family health insurance, and group health insurance provided by employers.

- Travel Insurance:

- Travel insurance offers coverage for unexpected events while traveling, such as trip cancellations, medical emergencies, lost luggage, and travel delays.

- Motor Insurance:

- Motor insurance provides coverage for vehicles against damages, theft, and third-party liabilities. It includes policies like comprehensive insurance, third-party insurance, and personal accident cover.

Importance of General Insurance:

- Financial Protection:

- General insurance provides financial protection against unforeseen events that can lead to significant financial losses. It helps individuals and businesses mitigate risks and recover from unexpected setbacks without bearing the full financial burden.

- Legal Compliance:

- In many jurisdictions, having certain types of general insurance, such as auto insurance or workers’ compensation insurance for businesses, is mandatory by law. Compliance with insurance requirements helps individuals and businesses avoid legal penalties and liabilities.

- Peace of Mind:

- Knowing that one is adequately protected against various risks brings peace of mind. General insurance allows individuals and businesses to focus on their activities without constant worry about potential financial losses.

- Risk Management:

- General insurance plays a vital role in risk management by spreading the financial risk across a large pool of policyholders. Insurers use actuarial science to assess risks and determine premiums, ensuring that the cost of potential losses is distributed fairly among policyholders.

Benefits of General Insurance:

- Coverage Against Unforeseen Events:

- General insurance provides coverage against a wide range of unforeseen events, including natural disasters, accidents, theft, and illnesses. It offers financial protection when individuals and businesses need it the most.

- Customizable Policies:

- Insurance companies offer various policy options and coverage limits to suit the diverse needs of policyholders. Individuals and businesses can customize their insurance policies based on their specific requirements and risk tolerance.

- Prompt Claims Settlement:

- In the event of a covered loss, insurance companies strive to settle claims promptly and fairly. This ensures that policyholders receive the financial compensation they are entitled to without undue delay, facilitating faster recovery from losses.

- Access to Healthcare Services:

- Health insurance provides individuals with access to quality healthcare services without the burden of high medical expenses. It covers hospitalization costs, doctor’s fees, diagnostic tests, and other medical expenses, ensuring that individuals receive timely medical treatment when needed.

Conclusion:

General insurance is an essential component of financial planning for individuals and businesses. It offers protection against various risks, provides financial security, and promotes peace of mind. By understanding the different types of general insurance, its importance, and the benefits it offers, individuals and businesses can make informed decisions to safeguard their assets and mitigate financial risks effectively. Investing in comprehensive general insurance coverage is not just a prudent financial decision but also a fundamental aspect of responsible risk management.

Recent Comments